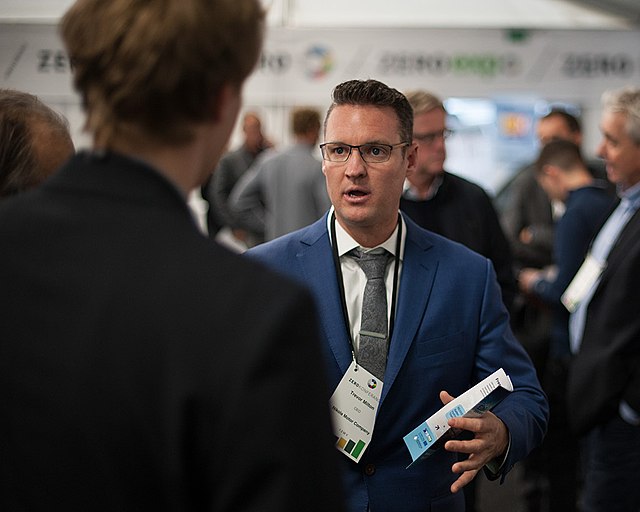

The culmination of legal proceedings against Trevor Milton, the convicted founder of Nikola, is set for Monday as he faces sentencing. In October 2022, a jury found Milton guilty of lying to investors, specifically accusing him of providing false information about Nikola’s technology. The charges included misleading statements about the company’s pickup development, battery sourcing, and the functionality of the “Nikola One” semi-truck.

Prosecution’s Call for a Severe Sentence

Federal prosecutors in Manhattan, who successfully argued Milton’s guilt, have recommended an 11-year prison sentence. They contend that Milton intentionally misled investors to inflate Nikola’s stock price and his personal net worth. This recommendation aligns with the sentence received by Theranos founder Elizabeth Holmes last year for defrauding investors in her blood-testing startup.

Defence’s Plea for Probation

In contrast, Milton’s defence team has requested probation for their client. They argue that any misstatements made by Milton were a result of his “deeply-held optimism” in Nikola and that the circumstances differ from Holmes’ case, where lies had potential medical risks. The sentencing decision rests with U.S. District Judge Edgar Ramos, who will preside over the hearing beginning at 11 a.m. EST in federal court in Manhattan.

Social Media, Podcasts, and TV Interviews: Milton’s Platform for Deception

Milton utilised various platforms, including social media, podcasts, and television interviews, to make false claims about Nikola’s technological advancements. These statements coincided with the company’s entry into public markets through special purpose acquisition vehicles (SPACs). Prosecutors argue that Milton’s actions were aimed at artificially inflating Nikola’s stock value and his personal wealth.

Milton’s Legal Standing and Company Ramifications

The founder was convicted on one count of securities fraud and two counts of wire fraud, while being acquitted on an additional securities fraud charge. Nikola, as a company, faced repercussions as well, settling civil charges with the U.S. Securities and Exchange Commission in 2021 by agreeing to pay USD 125 million. The aftermath of the legal proceedings has seen Nikola’s stock value plummet from its peak of over USD 60 in June 2020 to its current trade at less than USD 1.

The sentencing of Trevor Milton marks a significant chapter in the ongoing scrutiny of high-profile figures in the electric vehicle and tech industries. As legal proceedings conclude, the impact on Nikola’s reputation and the broader implications for corporate accountability in the evolving landscape of SPACs and public offerings remain noteworthy.